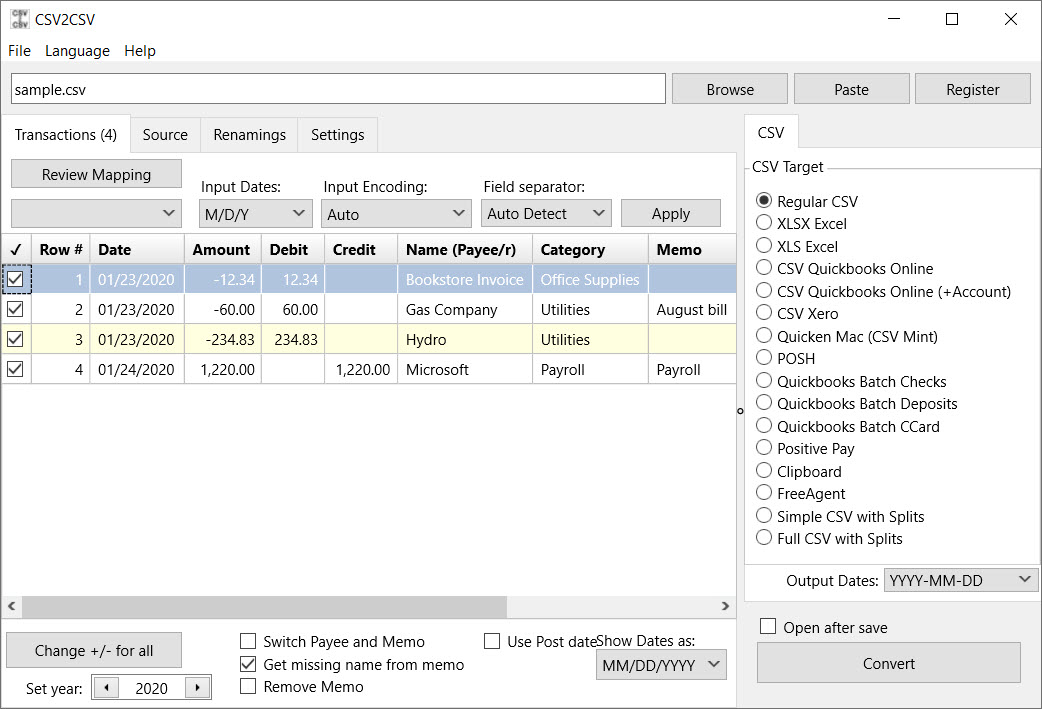

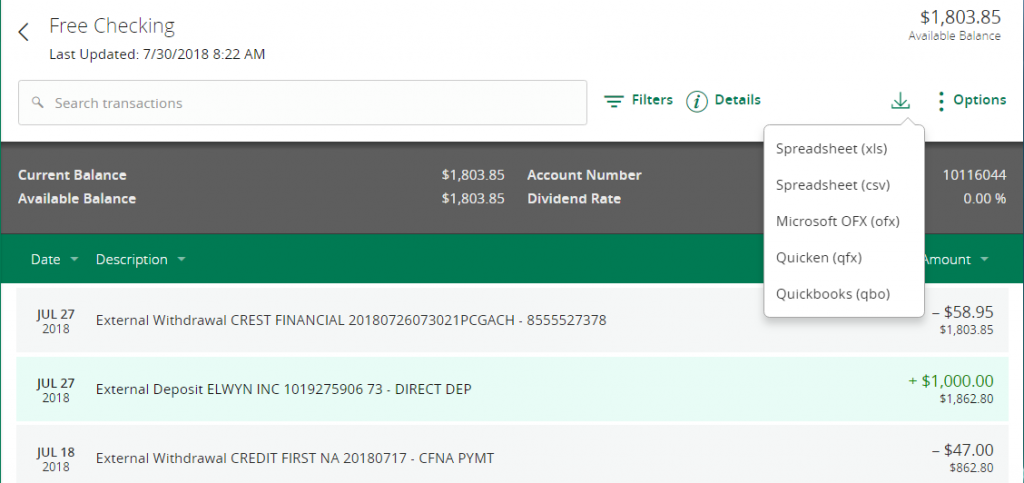

Mint download - CSV2QIF Convert 10.2.13 download free - CSV to QIF Converter for Quicken input. free. software downloads - best software, shareware, demo and trialware. Quicken will prompt you to back up your data file. Once the backup is complete, the linked checking account is created in Quicken with the same name as your investment account, plus the suffix Cash. Select the OK button to save your changes. Quicken converts all transactions in the investment account to their transfer equivalents. You can export your data to a comma separated value (CSV) file or a Quicken® QFX file. Alternatively, you may export your data directly to the Mint® online application. For more information, review the 401(k) Activity Download Guide on the Home Page of the Retirement Service Center.

I've searched this forum a little but not extensively so if this is redundant I apologize.I am very excited though.

I feel like Linus has kicked the football !!!!!!!!!!!!!!!!!!!

After using Linux for about 2 weeks, I was about ready to give up and go back to Windows as my beloved Quicken desktop was not being 'Wined'.

I sent a prayer (pray about everything worry about nothing) and a few hours later I was led to CrossOver https://www.codeweavers.com/

Linus kicked the football, ran down the field, caught it after bouncing off the helmet of the opposing team and ran for a touchdown.

Linus kicked the football, ran down the field, caught it after bouncing off the helmet of the opposing team and ran for a touchdown.

My distro is Mint Cinnamon ver 20. After several attempts with PlayOnLinux trying to convert (WIne is Not and Emulator) Quicken Premier 2019, 2015 and 2013, I gave up. And then I loaded CrossOver...... and created a Quicken 2019 Premier bottle

Transfer From Mint To Quicken

Initially, it did not look like it worked and want I got something that resembled a screen scrape of my last Quicken session. Relatively dejected I sent a nice nasty gram to CrossOver support asking for help and then, I looked at my desktop and tried it again. That's when Linus kicked the football. I opened my files with no issue. I am now a Linux guy and ain't goin' back. No need for VM. No need for dual OS. YES!!!!!!!!!Export Mint To Quicken Premier

The power of pray baby.

Export Mint To Quicken

Best to all of you.Quicken vs Mint – These 2 major personal finance tools have been competing for years! I’m breaking down the difference between Quicken and Mint. You’ll also learn if Quicken is worth the price.

*this post contains affiliate links

When it comes to managing your money, there are many personal finance tools that can help you track your expenses, write a budget, and check out your investments – all in one place. Many people are faced with the same problem: Quicken vs Mint: Who Should You Choose?

I know, I know. Choosing a personal finance software or app isn’t the most exciting thing in the world. But finding a program or app that works for you can change the way you view your money.

It wasn’t until we chose a program that worked for us that we actually KNEW where our money was going! Before we started tracking our expenses with a financial tool, I couldn’t tell you how much money we spent on each category in our budget.

But over time, our family was able to find a financial tool (keep reading to see if it’s Quicken or Mint!) that helped us know our finances inside and out. And once we knew more about our spending habits, we were able to make serious progress on our money goals!

Today, I’m breaking down the difference between Quicken and Mint. Hopefully, this will help you decide which financial tool is best for you.

About Quicken

Quicken has been around for what feels like FOREVER. The good news is that this long track record has given them an opportunity to learn what users really want from a personal finance program.

For over 30 years Quicken has been helping people keep their finances organized and in one place. They’ve learned over time exactly what users are looking for to stay connected to their money.

Quicken allows you to connect all of your accounts in one place. You’ll be able to track your expenses, manage your bills, write a budget, and more.

Because Quicken is a software program, you’ll need to download it to your computer. It will also need to be updated every now and then. There is an online component to Quicken which makes it mobile-friendly.

About Mint

Mint has been the top-runner for years in the personal finance app space. This means that they’ve had a long time to determine what their users want.

This free app and website allow its users to connect their accounts all in one place. Mint will connect to just about every bank in the US which allows you to see practically any account you have with the click of a button.

Mint automatically updates with your accounts so that you have a clear picture of how much money you have in all of your accounts at once.

Because Mint is free, expect to see ads in your app and online. They also make money when a user signs up for a sponsored service, such as a credit card or checking account.

Quicken’s Features

Quicken has many features to help keep your personal finances organized. In fact, they have so many options that it might just be a little overwhelming.

But here’s the good news: you don’t have to use all that Quicken offers. Even if you use just half of what this software provides, you’ll have a good handle on your money and where it’s headed. It’s time to determine if Quicken is worth it!

Quicken allows you to:

- Track your income and expenses. This is undoubtedly Quicken’s most popular feature. Quicken will categorize your expenses automatically so that you know how much money you are spending on each category in your budget. All you have to do is set up your categories beforehand and Quicken does the rest of the work for you!

- Manually track your expenses. If you don’t want to connect your account to Quicken, you don’t have to. Instead, you can manually add your transactions which allows you to track expenses that haven’t come out of your bank account yet (such as the rent check that hasn’t cleared or the electricity bill that will be auto-drafted in 5 days). This allows you to know how much money you have left in your account even after you pay all your bills.

- Set a budget. Easily set a yearly budget and track your progress each month. This is perfect if you want Quicken to easily pull in your expenses to your budget.

- View and manage your bills. You’ll never miss another bill! Get alerts and see bills before they are due.

- Track your investments. Quicken allows you to keep track of your investments all in one place. You’ll be able to review your portfolio and monitor your investments through Quicken.

Mint’s Features

Mint helps over 20 million users know their money better. Because Mint is free, it does have more limitations than Quicken. For instance, you cannot export a CSV file of your transactions to upload into Excel. It also lacks a running register because it relies on banks to clear any pending charges. So you won’t necessarily have a true picture of your money.

Mint allows you to:

- Track your income and expenses. Mint will automatically connect to your account and track the money you are spending. It will also automatically categorize your spending, but it’s not a perfect science. Chances are you’ll have to manually change some of the categories on your expenses.

- Track your monthly bills. Mint allows you to see all of your monthly bills in one place. Here’s hoping you never pay another late fee!

- Create a budget. Thankfully, Mint will let you know how much, on average, you’re spending in certain categories. This makes writing and setting a budget a little bit easier.

- Know your credit score. Mint allows you to check your credit score for free. They’ll also give you a free credit report so that you have a clear picture of your score.

Budgeting: Mint vs. Quicken

Quicken: Within Quicken you have the choice between creating a 1-month or 12-month budget (or both!). The 12-month budget will automatically add your recurring income and expenses into your budget. This means less work for you.

The great news is that you can update or change your budget at any time. This is a must because everyone knows that your budget probably won’t go as planned. And that’s okay! Quicken makes it easy to adjust your budget on the go.

Mint: In the beginning, Mint will actually suggest a budget for you to follow. They will calculate an average of how much you’re spending in each category and offer you an idea of how much you should budget. Then, you can always go in and make changes to your budget to fit your specific needs.

Tracking Expenses: Mint vs. Quicken

Quicken: Quicken allows you to easily track every expense or purchase you make. You can either have Quicken automatically categorize your expenses or you can manually categorize each expense.

What I personally love is that you can split one transaction into multiple categories! So if I wanted to pull out money for my cash envelopes, I could easily split the transaction into different categories inside Quicken.

Mint: Because Mint automatically connects to your bank account, it won’t update until your transactions are no longer pending. This means that you’ll be at the mercy of time to know exactly how much money you have left in your account.

So if you go on a shopping spree over the weekend, you might not know how much money is actually in your account until all the transactions clear on Monday.

Investments: Mint vs. Quicken

Quicken: In the Premiere version of Quicken you can easily connect and monitor all of your investment accounts in one place. You’ll also be able to easily evaluate your investments as well as see how your returns compare to market averages.

Mint: Inside Mint, you’ll be able to see all of your investment accounts in one place. This allows you to track your investments quickly and easily.

Synchronizing Accounts: Mint vs. Quicken

Quicken: You can choose to sync all your accounts with Quicken for easy access. If you’d rather have a little more control, you can always enter your expenses manually as well.

Mint: Mint automatically connects to all of your accounts every 24 hours. You can also “refresh” your accounts manually which tells Mint to check each account at that moment.

Mobile and Desktop Access: Quicken vs. Mint

Quicken: Because Quicken is a software program, it works best when used on a PC or Mac. If you connect your accounts to Quicken then you can also use the web version. Wishing Quicken had an app? Don’t worry! Quicken recently launched an app called Simplifi by Quicken.

Mint: Mint might be the #1 personal finance app out there. They’ve made it more user-friendly over the years as well. If you prefer to use a computer, Mint has you covered. You can also log into Mint online. This allows you to be in control of your finances from practically anywhere.

Pricing: Quicken vs. Mint

Quicken: The creators at Quicken know that not everyone wants an intense in-depth view of their finances. That’s why they’ve created three options for users to choose from: Starter, Deluxe, and Premier. If you want to use Quicken to mostly track your expenses and create a budget, then the Starter edition is perfect for you.

If you’d like to use Quicken to help you track your investments in-depth, then the Premier version is going to be your new best friend. Quicken’s ad-free experience (and the value they offer) comes at a price. You’ll be looking to spend anywhere between $39.99 – $74.99 each year depending on the version you choose.

Mint: Right now, Mint is 100% free. Expect to see ads inside your app. They also make money when their users sign up for sponsored products such as loans and credit cards.

Quicken vs Mint: Which is better?

All in all, I’m a huge believer in Quicken. Does it cost more? Yes, but it’s totally worth it! Not only does Quicken not have ads, but it’s incredibly easy to use. After just a few short sessions you’ll be sure to understand how Quicken works.

Overall, Quicken allows you to categorize your expenses and get to know your spending in-depth more than Mint. For our family, it’s worth the extra money to have a system that is super user-friendly and isn’t cluttered with ads!

The Bottom Line

Whether or not you choose to use Quicken to track your finances, the goal is to find a system that works for you. As long as you find something to help you take back control of your money and become more aware of your spending then you should be proud!

Just remember that whatever financial tool you choose – whether it’s Quicken, Mint, or something else – to try it out for a few months to see if it works for you and your family!